Performance in 2023 (weighted): +24.36%

If you didn't fight the tape, it didn't bite you: A look back to how my strategies fared last year.

Happy New Year, everybody!

2023 was a horrible year if you listened to The Experts. Then, you saw an economy that was sure to enter recession; you saw higher energy costs and nervous wartime consumers. High interest rates would destroy housing construction. The Macro folks were sure: a bull market simply does not begin at the elevated levels that stocks had at the beginning of the year.

Unless the “expert” you listened to was somebody like Stanley Druckenmiller, who said:

"The only good economist I have found is the stock market. People say it has predicted seven out of the last four recessions. That’s still better than any economist I know.”

2023 was not horrible, but still quite difficult if you were accustomed to how well a balanced 60/40 portfolio of stocks and bonds performed during the past three decades. Like a pendulum, one went up when the other went down, so you suffered very little volatility. Sadly, those days are over; in my opinion, the pendulum is broken. With the result: if you were invested in stocks, you experienced for instance a 10% drawdown in August-October which was frightening.

That’s why the year was challenging for me personally. I used to be a fan of low-volatility strategies, but in general, such things no longer exist. The drawdowns of March and in particular, October were hard to accept — until I understood that they were necessary in the new investing regime if I wanted to make money.

Remarkably, 2023 was a good year for an investor if they just concentrated on price signals. In other words, if they focused on what old-timers call “the tape”.

In February, I noted that most of my favorite signals were looking up. And after that, none of them ever turned back.

For instance, after the quite banal Golden Cross signal indicated a “buy” in February, it was never contradicted.

(This is not to be taken for granted. In your average beginning bull market, prices can whipsaw around the Golden Cross signal for a while, causing unwelcome, repeated buy-and-sell signals).

In no particular order, I’ll now present the results of my current strategies. Also, I’ll tell you how I evaluate both their performance and their potential.

But first, a summary:

Out-of-sample returns (in other words, performance after publication):

Risk Parity+Momentum: +21.4%

Benign Neglect (5% Canary), SPY: +10.65%

Novo-Nordisk: +49%

Downtrodden EMs: +24.34%

Baltic Dry w/SSO: +60.08%

A.I: +14.03%

The average of all 6 strategies: 29.92%%

However, using an unweighted average is not really meaningful — nobody would invest equal amounts in each strategy.

To try to attain a more realistic performance metric, I triple-weighted RP+Momentum, as well as Benign Neglect. And, I double-weighted the EM strategy. With this result:

The out-of-sample weighted average return for 2023 of all my six strategies is: 24.36%

1) Risk Parity Combined with Momentum

Full-year results: +31.9%

Out of sample (results since the strategy went live in May): +21.4%

Comments: I continue to like this one. Its strength lies in how it uses two separate signals to allocate funds on a sliding scale.

First, Risk Parity looks at your asset’s volatility to tell you how much you should invest. (The assets I use for this are Nasdaq stocks leveraged 2x, and Treasury bonds, leveraged 3x).

Then, it applies a fail-safe filter to help prevent you from getting destroyed in case one of your assets… is getting destroyed. Like, what happened to treasuries in 2022.

I wrote about this strategy here. It went through an unhappy episode in August, September and October, with losses in these months reaching a total of around -11%, which hurt but was still below the backtested historical maximum drawdown levels of 14.2%.

Going forward, I intend to continue to invest major funds in this strategy in 2024. Technology is where it’s at! (For the time being, at least).

Allocation for January: QLD=65.38%, the rest in cash.

A caveat: at the current high levels, we’d only touch the “sell” signal which is located at the 200-day moving average after considerable losses. Therefore, I’ll be taking some money off the table when any of my various stock market signals indicate caution.

2) Benign Neglect

AKA 5% Canary Investing: Selling the S&P 500 or the Nasdaq based on Andrew Thrasher’s “Confirmed 5% Canary” principle,while employing Bill Sadek’s 3% buy signal.

Full-year results:

SPY: 18.72%

QQQ: 31.42%

Out of sample results:

SPY: 10.65% (from the open on September 25)

QQQ: I only published my backtest of this in November, so the 2023 results don’t provide enough insight. For the weighted average of all my strategies, I am only using the SPY returns. I will change this for 2024.

Comments: A signal that tells you when the market is in danger of serious turmoil, but keeps you invested in most years: that would be a holy grail. And possibly, Andrew Thrasher has discovered something close to this ideal.

However, please don’t bet the farm on it.

His sell signal has worked excellently for major U.S. indexes for the past 120 years. Yet, when I recently tested it on Germany’s DAX index, it performed quite poorly, recommending re-entry into the market in 2002, and missing the 2008 crash. So it’s certainly not a signal for all indexes and all seasons!

Nonetheless, I will continue to invest major sums into both the SPY and QQQ, based on the 5% Confirmed Canary system.

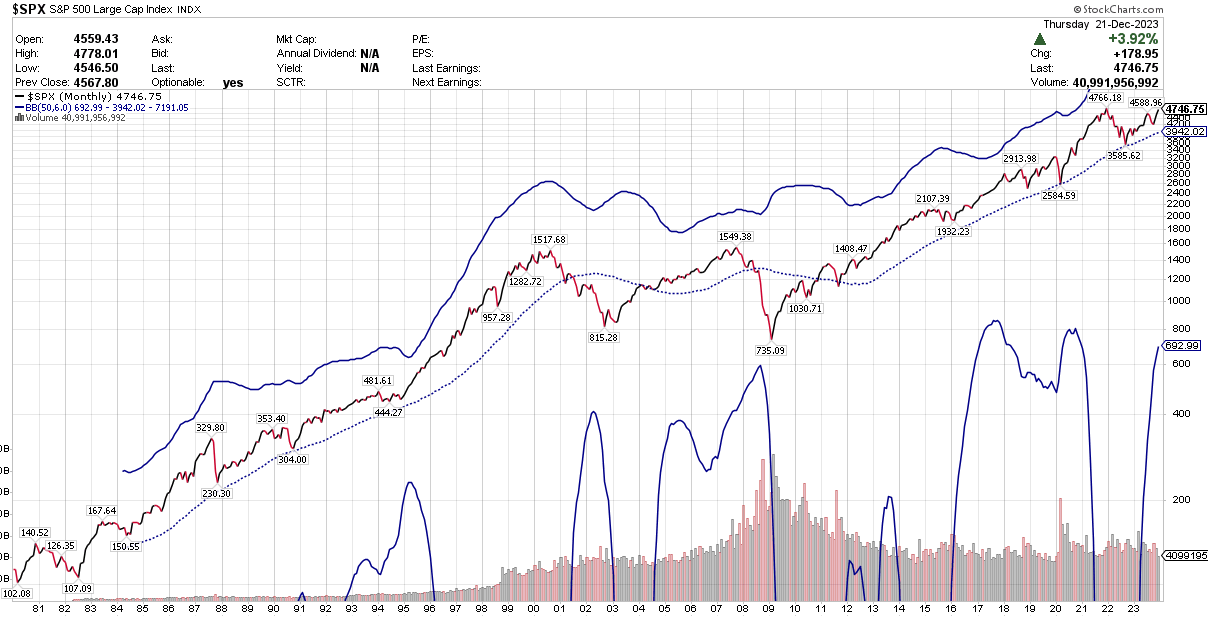

Additional parachute: if worse comes to worst, I’ll bail out based on monthly Bollinger Band data, even if a Confirmed Canary Signal has not been generated. I.e., sell at the dotted line:

Link to my post about the SPY strategy here.

Link to my post about the QQQ strategy here.

(Upcoming: I testing currently this strategy on the Dow Jones Industrial Average. Like and subscribe if this piques your curiosity).

3) Individual Stock Recommendations

This is not my forte, so I don’t expect to post more than a handful in any given year. But the case for Novo-Nordisk felt compelling when I published my recommendation on January 8.

Gains since publication till year-end: +49%.

Going forward: In the unfortunate case that Wegovy, NVO’s famously effective weight-loss drug turns out to be prone to by-effects, I’d hope that the market will sniff this out in due course. So, I’ll sell when NVO goes into Death Cross territory. Otherwise, I plan to hold until further notice.

4) Buying the Worst Emerging Markets

This requires a detailed explanation, which I have recently provided here.

Average result of all my recommendations till year-end: +24.34%%

5) Investing based on the Baltic Dry Index

Full-year results: +60.08%

Comments: This one is tricky, because it has functioned so well that I can only assume a lot of luck was involved. This dog may have had its day; who knows what tricks the investing gods will play on it next year.

Never forget: Any strategy that earns more than CAGR 15% is bound to blow up, sooner or later.

It has a tremendous ratio of reward to risk: CAGR of the 2x leveraged version since 2019 = 33.45%, maximum monthly drawdown -9.41%.

Going forward, I will continue to a) invest minor funds in the SSO (2x leveraged) version of this, and b) use this as a general bellwether of the global economy.

A bad Baltic Dry reading doesn’t mean a crash or a recession is immanent, but it does mean you should seriously think about de-leveraging.

Posts: first here, more recent here, most recent here.

The SSO strategy, via Portfoliovisualizer here.

6) Investing in the Artifical Intelligence Bubble (and other techy stuff)

The premise of this approach is: bubbles are an excellent opportunity to make money, but only if you really realize they can burst at any time, for no particular reason.

It’s human nature to become greedy, and therein lies the seed of ruin.

My approach is to buy and sell A.I. stocks and ETFs based on a short (three month) moving average which generates signals on a daily basis. Slightly unsophisticated, I know!

I wrote about this in late May.

Assets: AAPL, AMOM, ARKK, ARKQ, BIDU, BTC/Bitcoin, BOTZ, FIX, LSCC, IRBO, MSFT, PLTR, PWR, TSLA, UBOT.

Algorithm via Portfoliovisualier: here.

Average return of all 15 assets from June to year-end: 14.03%.

My Assessment: It wasn’t really worth the effort! On the other hand, we arguably haven’t entered bubble territory yet.

Going forward, I will cull BIDU, LSCC, FIX and PWR. I’m adding NVDA. I’ll keep you posted about any further additions and deletions.

7) Other approaches

I am close to abandoning one strategy about which I wrote in the summer:

Drftr’s Simplified Ultimate Momentum looks quite OK. CAGR since 2011 = 12.54%, maximum monthly drawdown 10.86%, results for 2023 = +14.51%.

It’s really not bad, but I find its total reliance on the 200-day moving average as a signal for its various assets a bit too simple. Several times, it underperformed buy-and-hold for stretches of up to two years, which can be crucial — one tends to abandon strategies that are performing poorly for many months, unless they are normally quite outstanding.

The PV link is here.

Another set of strategies I really like are two from Toma Hentea — but they have been in cash for most of the year, so I see no major reason to write about them here. Please read my above summer post for more information.

(That said: both of my favorite Hentea strategies will from January 2024 onwards be fully invested again).

Finally, I am invested in a number of dividend-grower corporations that I only sell if they cut their dividend, or run afoul of their own trend and violate the Golden Cross. These are now only minor investments; I do not think I have any particular qualifications in selecting such assets. I’ll update in the new year.

In Conclusion

All things considered, +24.25% is a lot better than I would have expected at the beginning of the year. I hope you might agree.

I hope the end of 2024 will see us in comparably good spirits!

Thank you for reading and commenting, and for accompaning me on this journey towards a better-invested life.

Martin, Happy New Year or Frohes Neues Jahr! Very comprehensive review. I particularly appreciate your honest and straight forward commentary on where you are at with each of the elements of the portfolio. Very well written! One question for you: how do you guard against recency bias (ie AI)? With that said, look at the unbelievable run technology in general has enjoyed post-2001. I hope you and your family have a very healthy, happy, and prosperous (with high Sortino ratios) in 2024.

This is a very thorough yet easy to read summary of the year’s results - well done! The comment that resonated most for me was “2023 was a good year for an investor if they just concentrated on price signals.” The Wall Street “experts” got 2023 wrong and that’s just another example that ‘price’ is the one thing that should be trusted. Good luck in 2024, and may your money grow rampantly!