Use A.I. to Decrease Volatility?

One of my daily reads is “Random” Roger Nusbaum’s blog. The other day he mentioned, in a rather offhand day, how he asked Grok how to reduce the volatility of a strategy that consisted of VTI, the Vanguard Total Stock Market ETF, and BTAL, the U.S. Market neutral anti-beta ETF. I’ve written about BTAL in the past.

I thought this deserved some further discussion, which is why I’m writing about it here.

In Roger’s words,

“Then I asked What is the best alternative strategy available in a fund to pair with BTAL to reduce volatility? So not even asking for a specific fund, just a strategy and (Grok) spat out AQR Managed Futures (AQMIX) which we use all the time for blogging purposes.”

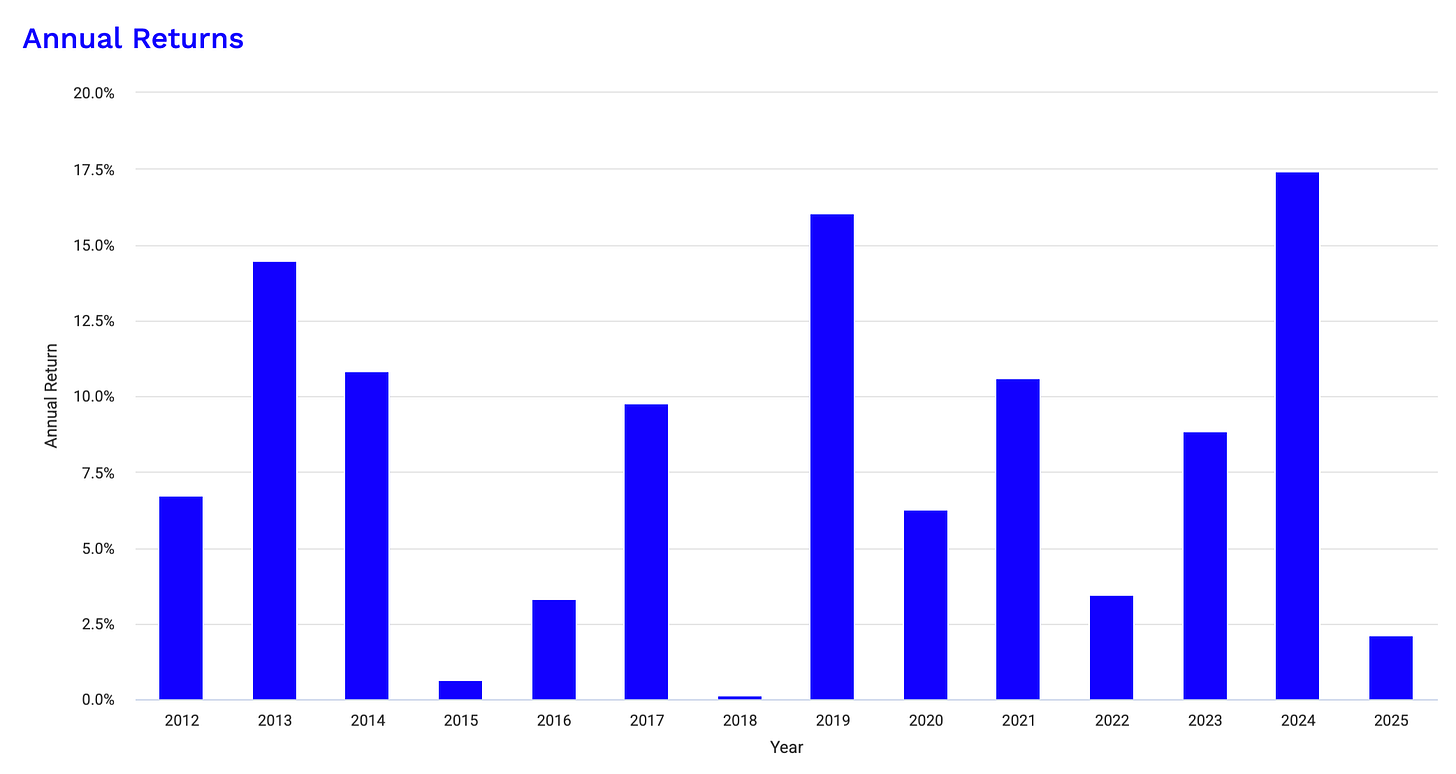

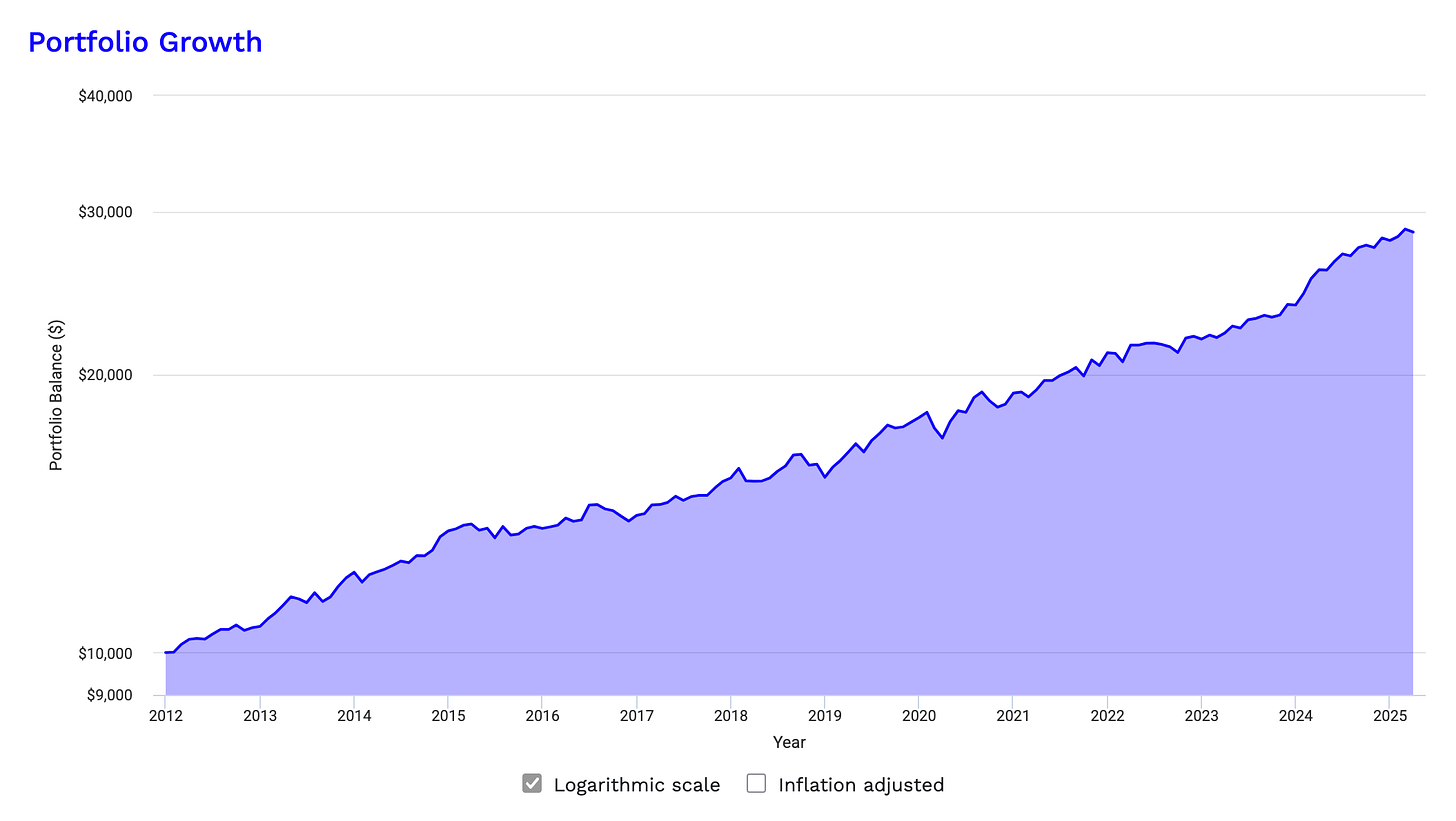

I played around with a combination of these three assets and was surprised that they mesh quite nicely. For example, with 50% VTI, 30% BTAL and 20% AQMIX, re-balanced yearly:

In words and numbers, from 2012 to end-March 2025: CAGR = 8.22%, maximum monthly drawdown = -6.21%, worst year = 0.16%, Sharpe 1.21, Sortino 2.19.

The numbers get slightly better with SPY instead of VTI (hello, Mag 7), and you can easily up the CAGR by increasing the share of VTI, but the risk-adjusted return doesn’t improve.

All in all, for a simple strategy that is only re-balanced annually, I find this performance quite impressive. Here’s the PV link.

What happened on ME Day? (I.e, yesterday’s Moron Economics day.)

VTI was down -3.46%, BTAL up 3.97%, and AQMIX up 1.24%, which averages out to -0.58%. Perfectly acceptable from my point of view, when you consider what a bloodbath yesterday was.

This is the first time I’ve seen anything remotely useful for investing coming from A.I.

Scary, or a nice taste of things to come? Tell me what you think.

Cool. Here is a QuantMage adaptation: https://quantmage.app/grimoire/266688980bf165290a299ed4dae07f97

I used CTA in lieu of AQMIX. KMLM is another option.

It's also possible that Trump's tariffs Wednesday were calculated by AI, for what that's worth. I'm waiting to hear which LLM they used.