Here's Another Signal I Find Very Useful

High-Yield Corporate Bonds like to tell a story, to which I think we should listen

First of all, thanks very much to all the new subscribers who have come here since Jaewon Jung followed up on my piece about Bitcoin. Glad to see you here!

And about that Bitcoin article: since reactions have been rather positive, I have decided to integrate it into my portfolio of strategies, starting March 1, with a single weighting. (As already announced in the most recent addendum to the article.)

Today, I am writing about another signal that might help indicate whether the net aggregate opinion of the market is currently positive, or negative.

My assumption for Bitcoin was that it appears to be a strong indicator of the animal spirits of the markets, as well as a measure of market liquidity.

In contrast, hi-yield corporate bonds may be less about the market’s general animal spirits, and more about what the smart money is thinking. Namely, whether bond professionals think it is prudent to lend money to corporations.

Under normal circumstances, in a healthy economic climate, corporate bonds are less volatile than equities, offering a good risk-adjusted return.

But when the economic outlook becomes so uncertain that increased corporate bankruptcies are in sight, then high-yield corporate bonds can react even more violently than stocks. As illustrated by this chart — the black line (high-yield corporate bonds) showed considerably stronger swings than stocks (red line) in 2020 and 2022.

HYG as a buy-sell signal for the S&P 500

My first strategy sells the S&P 500 ETF (SPY) whenever HYG, the hi-yield corporate bond ETF, drops below its exponential 100-day moving average. (And it buys SPY when HYG rises above its moving average).

You see, since HYG tends to drop stronger than SPY under market-stress situations, it can potentially ring a sell signal in a more timely fashion.

Instead of going to cash when I sell SPY, I buy BTAL, the U.S. Market Neutral Anti-Beta ETF. BTAL has in recent years proven to be an effective counterweight when stocks are in trouble.

Results are nice!

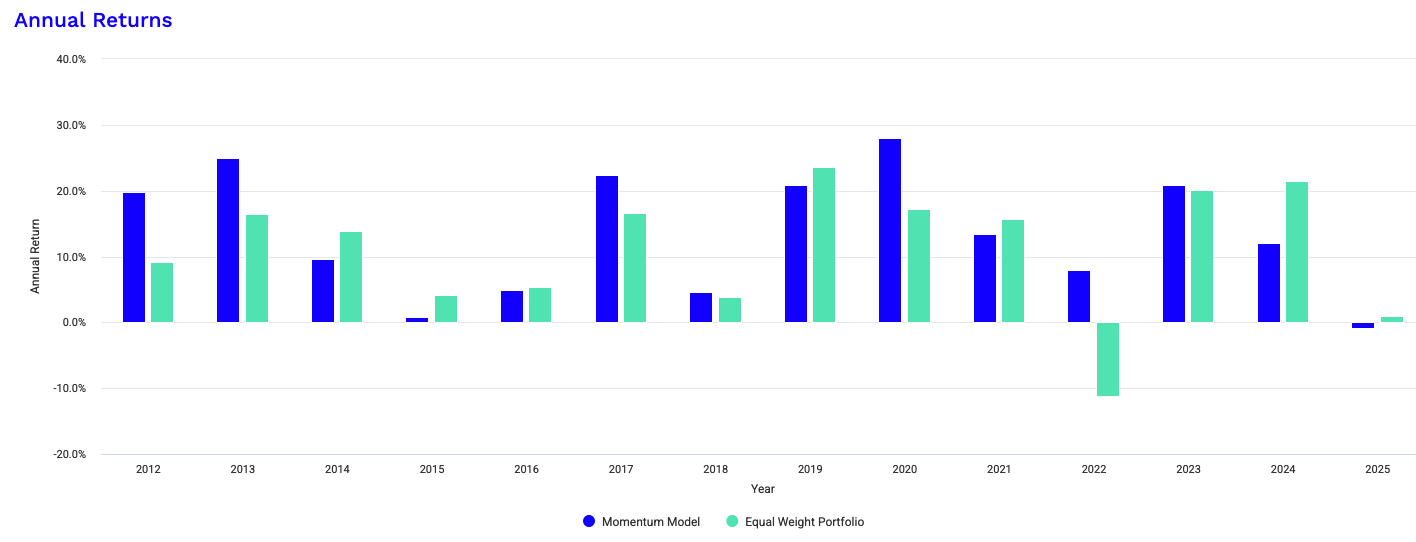

CAGR from 2012, to end-January 2025: +21.49%, maximum monthly drawdown -10.58%, worst year +2.69%.

And this is with an unleveraged strategy that uses only two quite popular assets, and doesn’t overcomplicate anything with intricate (and potentially overfitted) rules.

Granted, this is a strategy that buys or sells on a daily basis, so in these 12 years, you had to carry out 114 transactions. For those less trading-inclined, the weekly variant that only buys or sells on Mondays is still pretty good, though:

CAGR +17.92%, maximum monthly drawdown -17.92%, worst year +1.4%. Transactions in 12 years: 59.

Speaking of BTAL…

Investing in a traditional 60/40 portfolio of balanced stocks and treasuries was considered the prudent thing for conservative investors to do — until it blew up in and after 2022, when treasuries had an unprecedented three years of negative returns.

Which is why I am interested in BTAL as hedge. As its issuer says, it

“provides consistent negative beta exposure and can be used as an effective equity hedge to lower portfolio volatility and reduce the impact of drawdowns.

May be an effective alternative to buying Treasuries, volatility products and low-volatility funds if seeking to reduce overall portfolio risk.”

On a risk-adjusted level, a yearly-rebalanced 60/40 portfolio of SPY/BTAL beats both SPY/IEF (IEF being the 10-year treasury ETF), SPY/Gold, as well as buy-and-hold SPY.

Here, “Portfolio 2” is a 60/40 split of SPY/IEF, and “Portfolio 3” is a 60/40 split of SPY and GLD, the gold ETF, all from 2012 until end-January 2025. Having treasuries or gold in the mix leads to a slightly better return, but more than doubles the size of the maximum drawdown.

But here’s what I think is an even better way to use BTAL. (I’m not sure who the original author of this one is — let me know if it’s you!)

You filter SPY, QQQ (the Nasdaq ETF) and BTAL according to relative strength, using their 10-month moving average. Results from 2012 to end-January 2025: CAGR 14.16%, maximum monthly drawdown -7.87%, worst year -0.82%. You can replay it here.

And now for something rather weird

I hesitate to post this because it is really nucking futz. Backtesting a Bitcoin strategy is a bit silly because the explosive gains it went through a decade ago were really only a once-in-a-generation phenomenon, and I’d really hate to hear that somebody invested their hard-earned money on such a strategy, hoping to repeat its success.

With that warning, let’s look at how effective using HYG as a buy-sell signal would have been for Bitcoin. (In other words, using the same parameters of the first strategy in this blog post, albeit without BTAL.) From 2011 to end-January 2025:

Buying-and-holding Bitcoin would have been a somewhat less spectacular experience (not that anybody who did so has been complaining): CAGR +147.11%, max drawdown -83.68%, worst year -73.56%.

You can replicate this lunatic Bitcoin strategy here, but please only play around with it (and let me know how much fun you’ve been having). I forbid you to invest any real money in it.

Conclusions

After adding Bitcoin to my toolkit of signals last month, I will in addition be watching HYG on a regular basis.

BTAL to me is intriguing. Currently, I am at a loss which out-of-market asset to invest in when the next bear market inevitably arrives. Gold is already quite expensive, treasuries are no good in an inflationary recession, cash is king but hurts when inflation is more than 3%, alternative investments are too complicated, commodities are difficult in a global bear market. What’s your plan? What’s your take on BTAL?

Comments are appreciated!

one more thing I should add is that I try to be particularly careful before I actually invest in a strategy that does not go to cash in bad times. As pretty as BTAL looks, we don't know how it will perform in a deflationary bear market, in a quick '87ish crash, or in some godforsaken new kind of crisis. We *do* know what cash does in such circumstances, which is why Taleb calls it the ultimate hedge.

BTAL is a narrowly focused, equity-only, rules-based strategy betting on a specific stock characteristic (beta), while managed futures is a broader, futures-driven, often trend-chasing approach managed actively across diverse markets. BTAL’s like a precision tool for equity volatility arbitrage; managed futures is more like a Swiss Army knife for global market trends.

Many managed futures funds struggled during market downturns despite their design to thrive in such conditions because they often rely heavily on trend-following strategies that need sustained, identifiable price trends to profit—conditions that don’t always materialize in choppy or abrupt crashes. Rapid, trendless volatility (like in 2020’s COVID drop) or crowded positioning among CTAs can erode gains, while high leverage and transaction costs amplify losses when trades misfire. Unlike BTAL’s focus on a specific equity factor, their broader, futures-based approach can falter if global markets lack clear direction or if trends reverse unexpectedly.