40 days ago, I wrote about how high-yield bonds can provide a useful buy/sell equities signal. At the time, one criticism I heard was that with the S&P 500 having such a sky-high valuation, time-tested signals might be late to react. I’m sorry to say that might be the case.

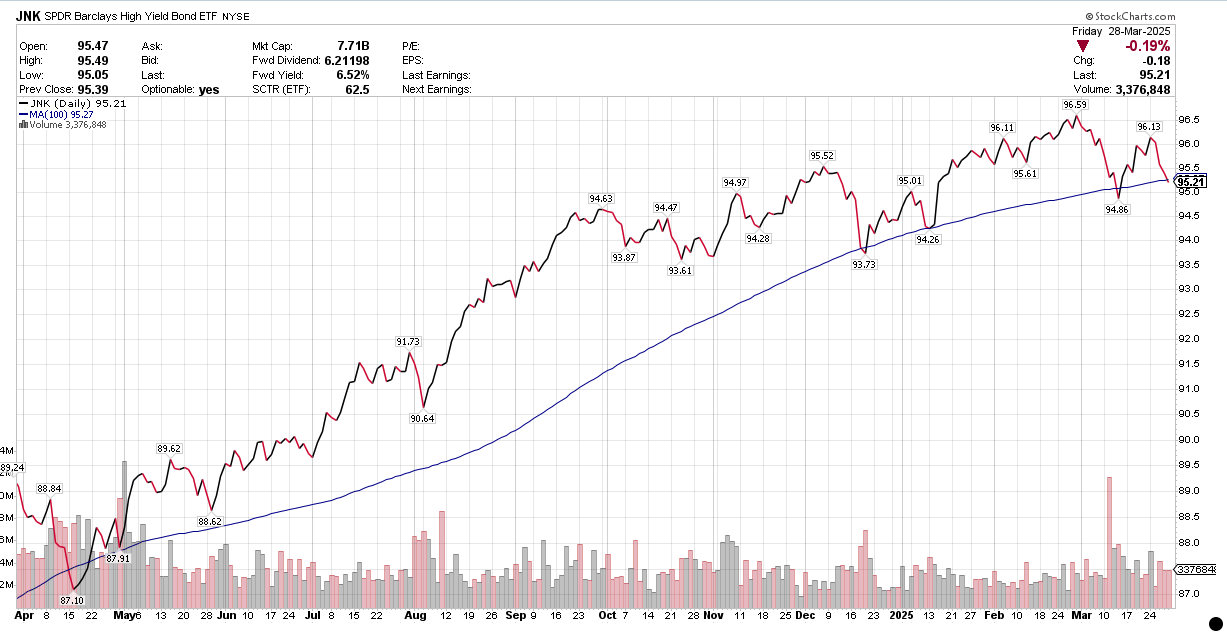

HYG, my signal ETF of choice, has not yet crossed the 100-day moving average threshold, but it’s getting very close. However, in contrast, in recent days related or similar ETFs have done so. Take the junk bonds ETF, for instance:

(Incidentally, using JNK instead of HYG is hardly detrimental to the historical performance of my strategy.

JNK: CAGR 20.37%, max monthly drawdown -10.27%, worst year 1.38%. Link here.

HYG: CAGR 21.22%, max monthly drawdown -10.58%, worst year 1.38%). Link here.

Before you panic however, note that using the 200-day moving average as a signal, instead of the former 100-day threshold, doesn’t destroy the strategy’s performance. With JNK: CAGR 15.75%, max monthly drawdown -17.8%, worst year-9.43%. Not terrible, but clearly inferior. In any case, we’re not close to touching the 200-dma quite yet.

Often employed: $$HYIOAS, the U.S. high-yield index option-adjusted spread. It’s considerably more jittery than HYG or JNK; for example it signalled risk-off in August 2024. Hence, it should come as no surprise it’s telling you to not own stocks. Jaewon Jung in one of his excellent blog posts uses its 330 day moving average as a signal to buy or sell the SPY. It doesn’t look pretty right now.

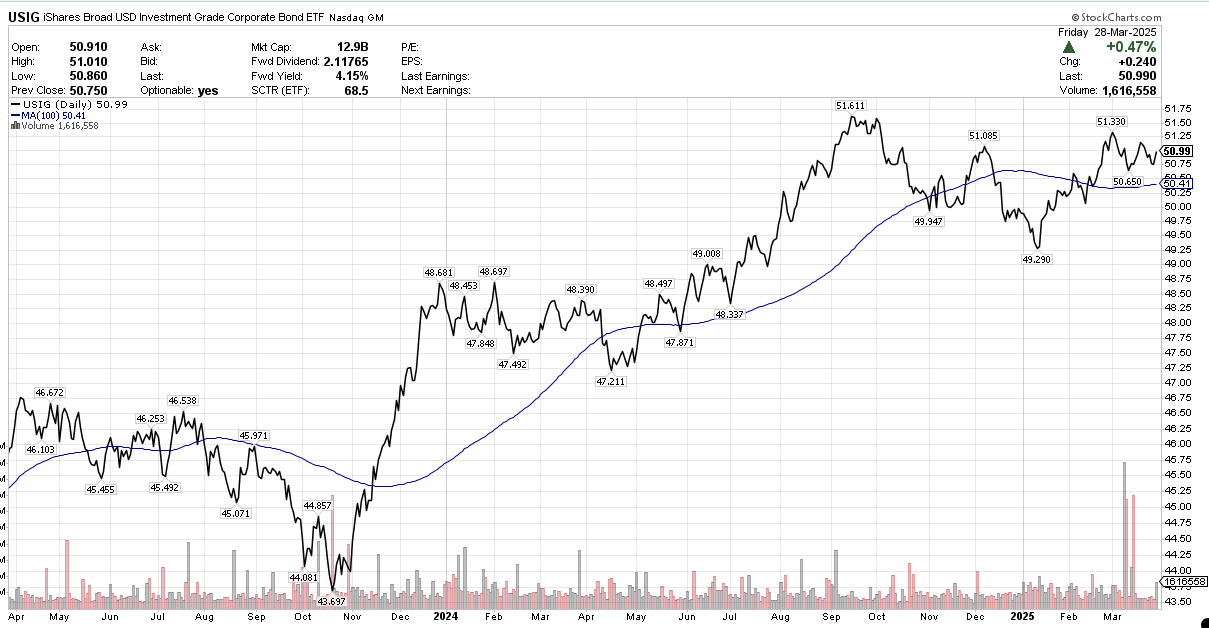

Corporate bonds however don’t seem to be too worried about a financial armargeddon. Using USIG (the investment-grade coporate bond ETF) instead of HYG as our buy/sell signal is actually comparable in effect to the high-yield stuff:

CAGR 20.74%, max monthly drawdown -10.53%, worst year-1.79%. Link here.

And USIG actually gained 0.47% during Fridays’s miserable market session.

To be honest, I haven’t a clue where this disparity is coming from. If the economy is tanking, why wouldn’t this be reflected in corporate bonds, as it normally always will? Tell me what you think, please.

In conclusion

Maybe the bond markets are as confused as I am. It would take but one sentence from Trump to re-ignite the animal spirits of the stock market, such as, “having spoken on very good terms with my friends, the leaders of China and Europe, I have decided to postpone any new tariffs until 2026”.

I have no idea how good or bad the chances for this happening are. I’ve been overwhelmingly in cash since my Canary signal call of March 12. Even if HYG and USIG do continue to be vaguely optimistic, I’ll prefer to wait and see how the latter-day Kremlinologists parse whatever words come out of the White House, before I make any decision.

Addendum March 30: I added links to the Portfoliovisualizer setups.

Martin, more seriously, if you came from the position of considering bet size more important than the position, then these signals would be effective in telling you to reduce the size of your bet or position. When the daily volatility is high, as it is recently, using these long term signals in binary fashion seems to set you up for more whipsaw.

This is worth watching, it's from Ken Moraif, CEO and Founder of RPOA Advisors, he has about $4 billion under management. Watch from 1:57 to 8:49 the rest is self promotion.

https://www.rpoa.com/trade-world-war/?utm_source=email&utm_medium=email&utm_campaign=email-market-alerts&utm_content=video