My apologies for this late post; I have started a new business venture which is very work-intensive (even though it’s rather small fries).

So here we are: the chips have fallen, and there are very few remaining reasons to stay in cash. Before I tell you what I’m doing, let’s see which lessons have been learned.

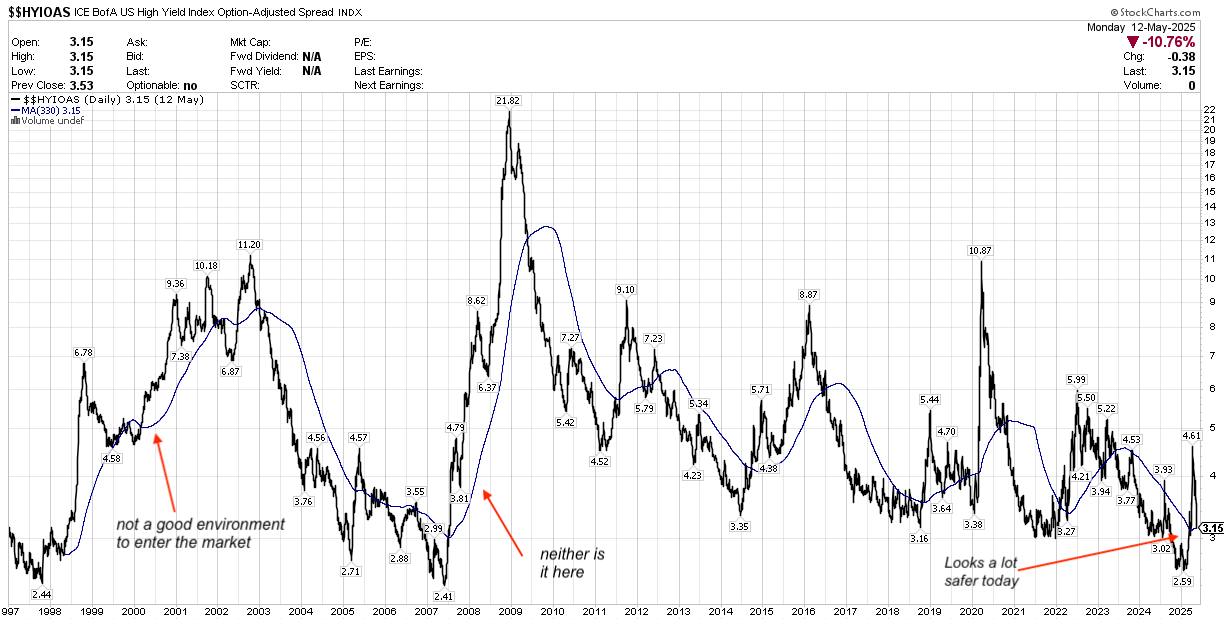

a) High-yield Bonds and Bitcoin seem to be pretty useful indicators

In my last post, I took a look at which of my favorite strategies had re-entered the market.

Buying the S&P 500 based on moving averages of Bitcoin led you to purchase SPY on April 22, with a gain of 14.3% in the meantime.

Using HYG (high-yield bonds) as an indicator, you re-entered the market on April 24, meanwhile earning 9.6%.

The logic of these strategies sounds straightforward enough to my ears. Bitcoin is great for insider trades. If you know somebody who’s eavesdropping on the campfire talk at the White House, you can exploit your knowledge by buying Crypto. (Heck, in Germany you can even do this trade tax-free — our authorities haven’t worked out how to see what’s in a crypto wallet, or somehow aren’t interested).

The bond market on the other hand, is staffed with some of the biggest brains in finance. One follows the smart money.

I previously mentioned there was a divergence between HYG and $$HYIOAS, the high-yield spread indicator. No longer; the indicator has normalized (chart below).,

b) The Trump Whisperers now seem to be certain of TAF (i.e., Trump always folds).

Here’s what they’ve been saying for months: When the going gets rough, he’ll always throw in the towel. Don’t listen to the loudmouths — when the market swoons because Lutnik is talking weird, you can buy the dip.

This time, the Whisperers were right.

They were wrong in early 2025, when they said the market could do nothing but go up with such a business-friendly President, who by no means would adopt a risky and business-unfriendly tariff policy.

So for the time being, TAF is the rule. The market apparently sees future tariff conflicts as playing out something like this: Trump cancels a previous deal. Trump introduces a crazy-high new tariff. The targeted foreign country shrugs, or places counter-tariffs to industries that hurt MAGAland the worst. Trump folds and declares a major victory, with minor changes to the previous regime.

(When you can say anything you like, and they still believe you, you sure have a lot of squiggle room!)

Will it work out this way with the upcoming tax deals? Conceivably, the Trump Whisperers can get it wrong again, and be the victims of their own false optimism. $TNX, the 10-year treasury yield, is rising parallel to the stock market. At some point, one of the two has to give. Let’s watch what happens if and when the 10-year gets to the levels it had in October 2023.

b) Breadth Thrusts matter

The Lowry Breadth Thrusts in early April were indicative of something strong going on.

There is always a reason to ignore such signals. Cam Hui for instance, for whom I have the highest respect, has pointed out that these breadth thrusts have only worked in the past when the Fed or when fiscal policy was playing fire department.

He had a point. Yet, this time, he was wrong, it seems.

c) Cash is enviable, unless you’re in cash

“Citadel's Griffin Says He Probably Should Have Sat in Cash Over the Last Month”: he’s saying that because he wasn’t in cash. My March 12 sell-everything call on the one hand reduced volatility by a major degree. On the other, FOMO is still a major cause of anxiety. Every darn explosion to the upside felt like the market was playing games with me.

(If the market had crashed in the mean time, I’d probably be relating other feelings. But it didn’t, so I’m not).

d) The “Ultimate Indicator” delivered the goods

$SUPA200R for the win!

Scroll down to ““Steve Strazza’s "signal of all signals"“ in my recent post.

So, is there any downside left to this market?

Overvaluation (at a 30x P/E, how much potential does the S&P 500 still have?)

Policy uncertainty (a 30 day tariff pause is not by itself a clear tariff regime. As they stand, the tariffs are still the largest tax increase in decades.

King Trump still owes fealty to Emperor Bond Vigilante (I refer to the above-described $TNX factor).

My version of the Thrasher 5% Canary model does not see a re-entry to the market until 4 months after a “sell” signal was generated. That would be not before July 12, 2025.

This is an admittedly curve-fitted addition to the original strategy, based on the 2007-2008 experience: the sickening reality of a deep recession can take months to enter the collective investing psyche. The first drawdown is often followed by months of false optimism, followed by the real 50%-80% permacrash.

Is this something like 2007-2008? $$HYIOAS (options-adjusted high-yield spreads) doesn’t seem to think so.

So, what am I doing?

For a start, I am re-investing what I sold on March 12. Half into SPY, based on market strength.

The other half is going into EFA (MSCI World minus USA, based on market strength and reasonable valuation).

I will use both the Bitcoin and the HYG signals to temper these investments, reducing allocations in a manner to be determined.

Stay tuned! And thanks for reading.

Thank you for the enjoyable read. You take all the misery out of economics.

I’d sure like to see the Semis break out of the channel they’ve been in for months.