What Are the Winners Doing Right Now?

In which I attempt to make up my mind, based on what some well-performing strategies are recommending

The last time I posted, I mentioned I was waiting for three factors to change before I joined the bullish camp.

a) A better-looking high-yield option-adjusted spread. Results: improvements, but not quite where I want it to be.

That said, the absolute level of $$HYIOAS is historically not at all very high. From 2012-2017 for instance, it was seldom below the current level. But backtests indicate it’s less the absolute level, than whether it’s above or below its long-term moving average that counts.

b) Anchored volume-weighted averaged price: For the S&P500 and the Nasdaq, the case is closed — the technical line has been breached to the upside, big time.

Looking at Papa Dow however (and some folks say the Dow is still the most important index), the situation as of Friday evening is not quite clear yet.

c) As a third criterium, I mentioned that I’d wait for a final flush out and rebound, à la Lowry Thrust. And boy, have I got some egg on my face. A sharp subscriber named Sebastian pointed out that indeed, a Lowry Thrust had by most accounts occurred on April 6/April 9.

I knew when I started blogging in 2022 that sooner or later, somebody would point out a major malfunction. I was hoping for later!

So, maybe two out of three arguments are in favor of this being a new bull market.

Or one out of three, if the Dow can’t gain enough from here?

One remembers Bob Farell's Ten Market Rules, of which #8 is: “Bear markets have three stages -- sharp down, reflexive rebound, and a drawn out fundamental downtrend.”

By that token, we could easily be in the second phase.

One might also keep in mind that Mark Moebius is 95% in cash — he’s holding his horses for another three or four months, until tariff things play out. And that Warren Buffett is keeping his powder dry, too.

As his pal Charlie Munger said, “the big money is not in the buying and the selling, but in the waiting.”

Easier said than done, though!

Obviously, I can’t make up my mind.

So I figured: let me look at some of the strategies that I like. Let’s see which ones have performed reasonably well in 2025. And let’s see what they’re doing in May!

1) Bitcoin as a signal for buying or selling SPY (or whatnot)

YTD (year-to-date): +3.22%

CAGR since 2012: 13.02%, maximum monthly drawdown -7.65%

Current allocation: buy SPY

Comments: while at first glance, this signal appears to be so wacko I am fearsome of investing my own money based on it, it does seem to have merit. Alternatively, you can use it to buy URTH (the MSCI world ETF) or EFA (world ex-USA). Since the U.S. was the world’s investing paradise until recently, these latter two ETFs have underperformed historically, but this year they’re da bomb — +14.64% for EFA if you used this signal, for instance.

2) Junk as a signal for buying or selling SPY (or whatnot)

YTD: -8.68%

CAGR since 2012: 19.99%, maximum monthly drawdown -11.07%

Current allocation: buy SPY, sell BTAL

Comments: Obviously, I can’t call this strategy a winner based on its year to date performance. HYG, the iShares High Yield Corporate Bond ETF, did not anticipate the surprise of Liberation Day. (I guess few of us did?) What was supposed to be a signal that was sensitive to changes in the business cycle was overtaxed when asked to warn against political rug-pulls.

It is disconcerting and concerning when a strategy goes into new low drawdowns shortly after you think you’ve discovered it.

That said: using this strategy, EFA (MSCI world ex-USA) gained +4.55% this year. Since I’ve been on the record for weeks that if I was investing at all, I’d be buying EFA but not the S&P 500, you might consider this to be a consolation prize.

Going forward, I continue to think this approach has merit, though not necessarily quite enough merit to navigate the current tariff-connected chaos.

3) Greedychicken’s Adaptive Allocation

YTD: +8.39%

CAGR since 2007: +12.36%, maximum monthly drawdown -16.04%

Current allocation: 78.53% SPDR Gold Shares (GLD), 10.22% iShares MSCI Emerging Markets ETF (EEM), 11.25% SPDR S&P 500 ETF (SPY)

Comments: One of my subscribers and a frequent helpful commentator, GC has a load of excellent investing ideas that are worth a closer look. This one weighs ten different assets according to minimum variance rules. This can be an fantastic approach if you happen to be, as I am, a member of the Church of What’s Happening Now.

I think overweighting gold may be a bit audacious right now, but the strategy’s track record is good enough to override any qualms I might have.

4) Risk Parity, with Small-Cap Value and Gold

YTD: +9.75%

CAGR since 2005: +10.65%, maximum monthly drawdown -20.08%

Current allocation: 60.50% Gold Price Index, 39.50% Vanguard Small-Cap Value ETF (VBR)

Comments: Joachim Klement (his Substack is highly informative and entertaining, you need to subscribe to it!) made the remarkable observation that you can model private equity returns by just investing in small cap value stocks.

So I thought, how about integrating this factor into an inflation-resistant strategy? It only employs gold and the small-cap value ETF; allocation percentages are determined by their volatility.

I like to be invested in assets that aren’t in the news, and have comparatively low valuations, as is the case with VBR (currently with a P/E of around 15.7).

It performed reasonably well in the years 2012-2016, when gold was in a downtrend, so no particular worries on that front. So we have inflation covered with gold, deflation with small cap value, and bullish years again with small caps. I suspect this strategy wouldn’t have saved anybody’s neck in 2000-2002, but then again, it’s just a diversifier, not the primary foundation of an investment strategy.

5) Conservative Three-Asset Split

YTD: +8.45%

CAGR since 1993: +7.05%, maximum monthly drawdown -8.94%

Current allocation: 34.00% cash, 33.00% Intermediate-Term Treasuries, 33.00% Gold

Comments: My respect for Harry Browne’s all seasons strategy that intends to weather all economic storms with just four assets (stocks, treasuries, gold, cash) has no limits. This one is my take on Harry Browne’s Permanent Portfolio.

Instead of carrying a 25% cash rucksack all the time (as the original HB strategy does), it only goes to cash as an out-of-market asset, when something is amiss.

Its growth rate of 7% is nothing to write home about, but the risk-adjusted returns over 30 years are quite good in my opinion. Under most conditions, drawdowns were under 5%; only in two cases of extreme market stress was this level breached.

6) Toma Hentea’s Holy Grail

YTD: +1.63%

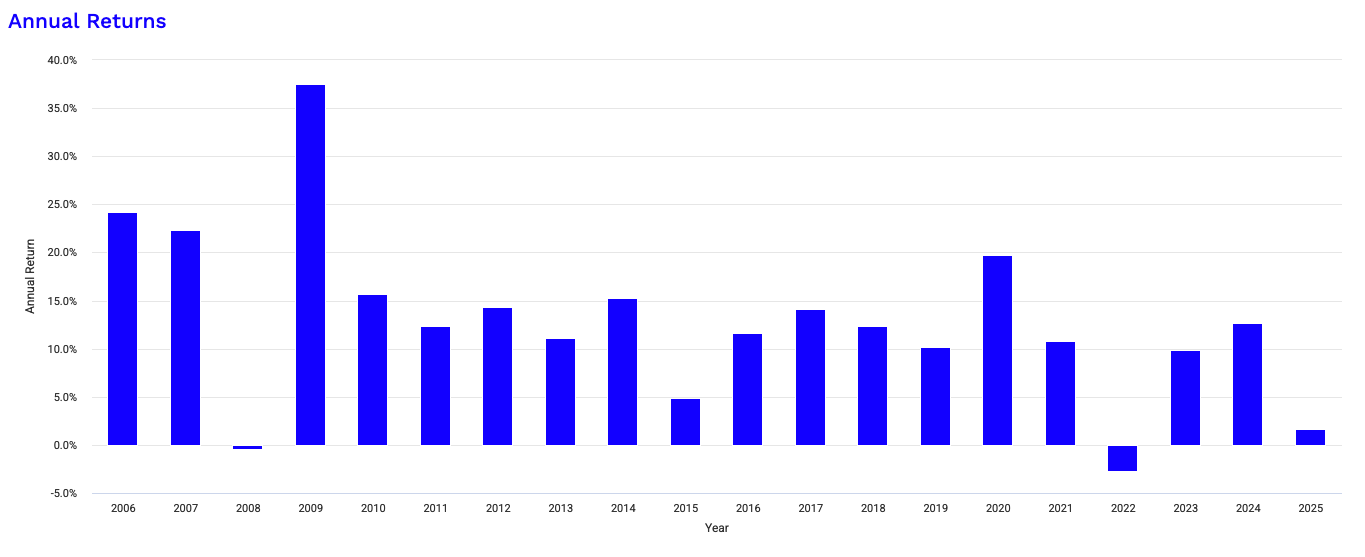

CAGR since 2006: +13.01%, maximum monthly drawdown -15.96%

Current allocation: 25.00% GLD, 25.00% EFA, 25.00% China Large-Cap (FXI), 25.00% TLT

Comments: Shamefully, I neglected this strategy in the go-go years of 2023 and 2024, because gains of 9% to 12% didn’t satisfy my greedy expectations.

It’s a dual momentum strategy, investing in four different assets from a selection of ten, based on the Vanguard Total Bond Market fund. Hence, a certain similarity in logic to my HYG signal, but a totally different implementation.

The charm of Toma’s approach is in its steadiness.

Honestly, if anybody offered me this kind of yearly returns going forward, I’d be a fool to refuse.

With Vanguard funds, one can backtest this strategy back to 1997. Results are similar, but there is a stretch of underperformance from 2000 to 2002. So beware if you think we are morphing into a post-bubble international malaise situation.

Conclusions:

According to Torsten Slok, tariff negotiations on average take 18 months. So I don’t expect a clear resolution to the current situation any time soon.

But even if you’re in the camp of those who think the worst is still in front of us — that the 200-day moving average of the S&P 500 is going to be a hell of a barrier to breach — there are some assets you could consider buying, at least for a trade.

Of course, trading means you’re hoping to have timing luck, and that past performance is indicative of the brave world that lies ahead of us.

Some of the strategies that I like say the world (EFA), Gold, treasuries, Emerging Markets, or China are currently investible. Maybe even the S&P 500, as long as Bitcoin and/or junk bonds say so?

Momentum can be your friend. Just don’t stick around too long if it really looks like a recession is coming.

Thank you, Martin, for another timely and excellent article.

I wonder if normal strategies are completely applicable in a situation that was created and is solely dependent upon the whims of the creator. Personally, I began scaling into SPY (with small amounts) last week. One worry is the big slowdown of containers arriving at the Port of Los Angeles.

Martin, these are a great smorgasbord of indicators. And it's wonderful that you bring them out and offer them at a point of uncertainty and inflection.

Also, thanks for the Klement link. I do subscribe to him, but I missed that one.