No Such Thing as a Sure Thing in Investing

a quick reminder...

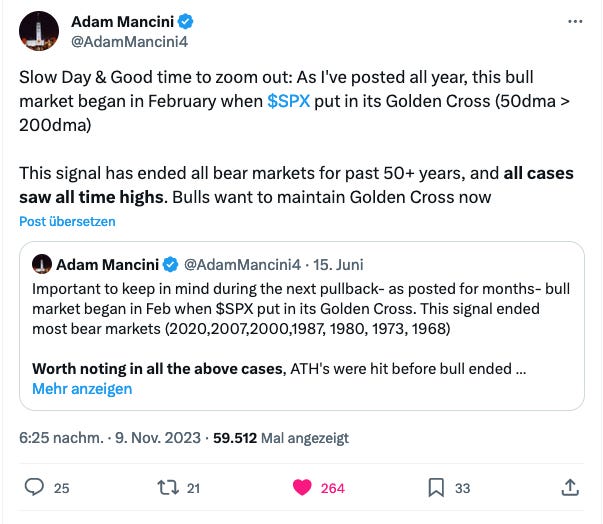

The things people say when they’re on the Xitter! Here’s an interesting statement from a few days ago:

My kind readers will know that I like the Golden Cross, i.e. the signal that occurs when the 50-day-moving-average of an index crosses over its 200-dma. It’s not perfect, but it’s perfectly useful in many cases.

However: “(the Golden Cross) has ended all bear markets for past 50+ years, and in all cases saw all time highs”?

Really? That’s hard for me to believe. So, I had to check this.

The data

For the SPX - the S&P 500 index — Yahoo has data spanning 79 years, beginning 1944.

Within this time period, 39 buy signals were generated by the Golden Cross. Most ended positive; in other words an investor didn’t lose money if he bought the SPX after a Golden Cross, and sold it at its Death Cross (which is the opposite signal: it is generated when the 50-day-moving-average of an index crosses under its 200-dma).

However, there were 5 episodes that ended negatively, with an average loss of -9.15%. This directly contradicts Mancini’s assertion that you couldn’t lose money when you bought the Gx.

The negative episodes were in: 1947, 1948, 1957, 1990, and 2019.

The fact that two negative transactions occurred in the 1940s could be concerning. The present economic situation is somewhat comparable to the post-war period — with a possible economic contraction coming after a time of rather high government spending. (Nota bene, I said “comparable”, and not “similar”…)

Why this matters

A 100% secure and reliable signal would be close to a holy grail. Why, if I knew you could never go wrong with the Golden Cross, I’d just buy the 2x leveraged S&P500 index (the SSO ETF), do nothing until the next sell signal was generated, and look forward to perpetual double-digit growth!

Sadly, that is not a viable strategy, unless you are willing to tolerate the occasional loss of 20% of your wealth (as calculated by the average possible loss in the past, multiplied by 2 through leverage).

If not worse. Another rule of investing is that things can always turn out in historically never-seen-before bad ways.

There was the crash of 1987 (an unprecedented 30% loss in one day), the Dotcom bust (unprecedented 90% loss for tech), the Japanese bubble’s burst (unprecedented 30 years of no stock-market gains), the 2022-2023 bonds bear (unprecedented losses of two years in succession for treasuries).

Who knows what’s next? A string of five bad Golden Cross signals? It’s highly unlikely, but it would be conceivable.

Investing is all about probabilities. Don’t believe anybody who says they know something is certain.