Emerging-Markets Mean Reversion: Results for 2024

+4.19% vs. +7.99% for VWO

Happy New Year, everyone! May our returns for 2025 be better than what I earned last year with emerging markets, because this was really nothing to write home about.

To recap: I employed Mebane Faber’s very simple and time-proven (120 years of data!) method of buying emerging-market countries that are down several years in a row.

As I described one year ago, if a country is down two subsequent years, it then gained on average +19.03%.

If the negative record is even three bad years, the average gain is then a remarkable +30.3%.

I like these numbers. In addition, I like the double distribution of risk that comes with a) a completely different approach in comparison to my other strategies. Mean Reversion (buying what has broken down) is pretty much the opposite of buying whatever has been worked well in recent months (momentum).

And b), it feels good to be invested in countries that have low valuations, in contrast to the U.S., which has become historically pricey.

So much for the theory. In practice, a diversifier will often work two ways: nice to have when your other assets are in trouble, but annoying in a year where the S&P500 is performing excellently.

(Of course, there is always the third variant: where your main assets are doing fine, as does your diversifier. That’s how it worked out for me in 2023, when my emerging-markets approach earned +24.34%.)

How much is the diversifier effect worth to you?

Another problem: the ETFs that one can use to invest in these countries often underperform. This effect was uncomfortably noticeable this year. Here is the data for the assets in which I was invested:

Philippines: Index = 0.0%; ETF = -2.24%

Malaysia: Index = 20.8%; ETF = 17.28%

China: Index = 19.7%; ETF = 15.53%

South Africa: Index = 7.4%; ETF = 1.86%

Qatar: Index = 6.1%; ETF = 3.54%

Thailand: Index = 1.6%; ETF = -3.4%

(Sources: ETF via Portfoliovisualizer.com, Indexes via Novelinvestor).

Taken as such, this performance is not too bad, as it averages out at a return of +5.4%. Compared to the emerging-market ETF VWO which gained 7.99%, the result is so-so, but not terrible, after last year’s quite good outperformance of +14.07%.

However, for 2024, I made a judgement call of double-weighting the Philippines, and half-weighting South Africa, Qatar and Thailand. The resulting weighted average: +4.19%. Bummer!

The Dilemma for 2025

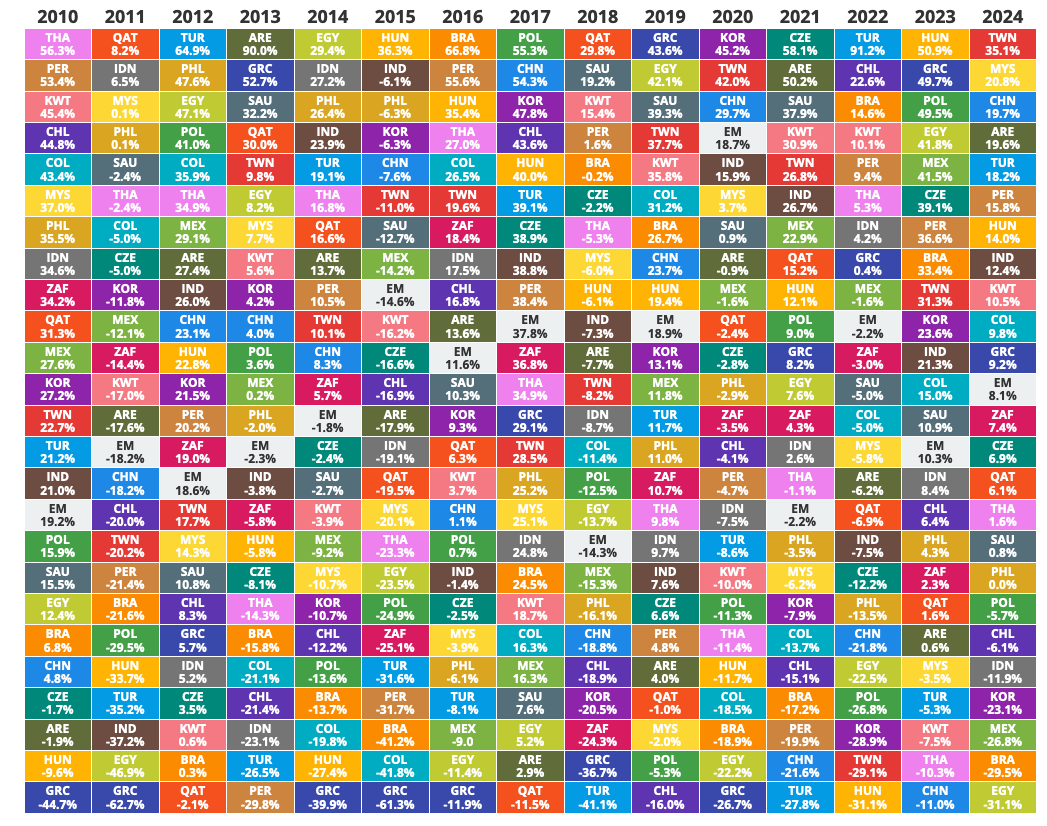

Here’s the table with the current data:

Exactly zero countries have been in negative territory for two, not to mention three, years. So according to Meb Faber’s classic approach, none are investible.

One could take a flying leap and simply buy the worst performers (Egypt, Brazil, Mexico, Korea, India, Chile) with the intention of holding them for two or three years if necessary.

Personally, I’m going to pass on this one, since my base case calls for a recession in 2025 or 2026. Emerging markets certainly did not outperform in 2008 (VWO: -52.49%) or in 2022 (-17.99%), so buying and holding for 24 to 36 months doesn’t sound attractive enough to me, all things considered.

We’ll talk again in early January 2025! Until then, why not let me know: are you invested in EMs? If so, in which ones? Or how else to you diversify internationally?

Addendum January 3: It seems my purchases of early January 2024 were based on data that had not yet integrated the full results of 2023. This was highly detrimental to the strategy’s performance. Due to this error, I bought country ETFs where the purchase was not justified by the data: Philippines, South Africa, Qatar, and Thailand.

The only country ETFs that were actual buys as indicated by the correct data were China and Malaysia. If I had restricted my purchases to these two countries, the average gain would have been +16.40%.

So, it seems the approach is still excellent, but requires double-checking the source. My apologies to anyone who followed my example and purchased the ETFs that were erroneously included.

I recently bumped into this LinkedIn post, which can be relevant to your EM mean reversion strategy:

https://www.linkedin.com/pulse/sector-adjusted-global-stock-market-valuation-outlook-keimling-ueq3e/

A good, honest article. As Steve says, EMs have not come close to completing with the US for the last 15 years. Personally I won’t be putting any capital in that space until they show solid momentum.